Empower

teams with AI

Achieve your online education goals with Automation Academy.

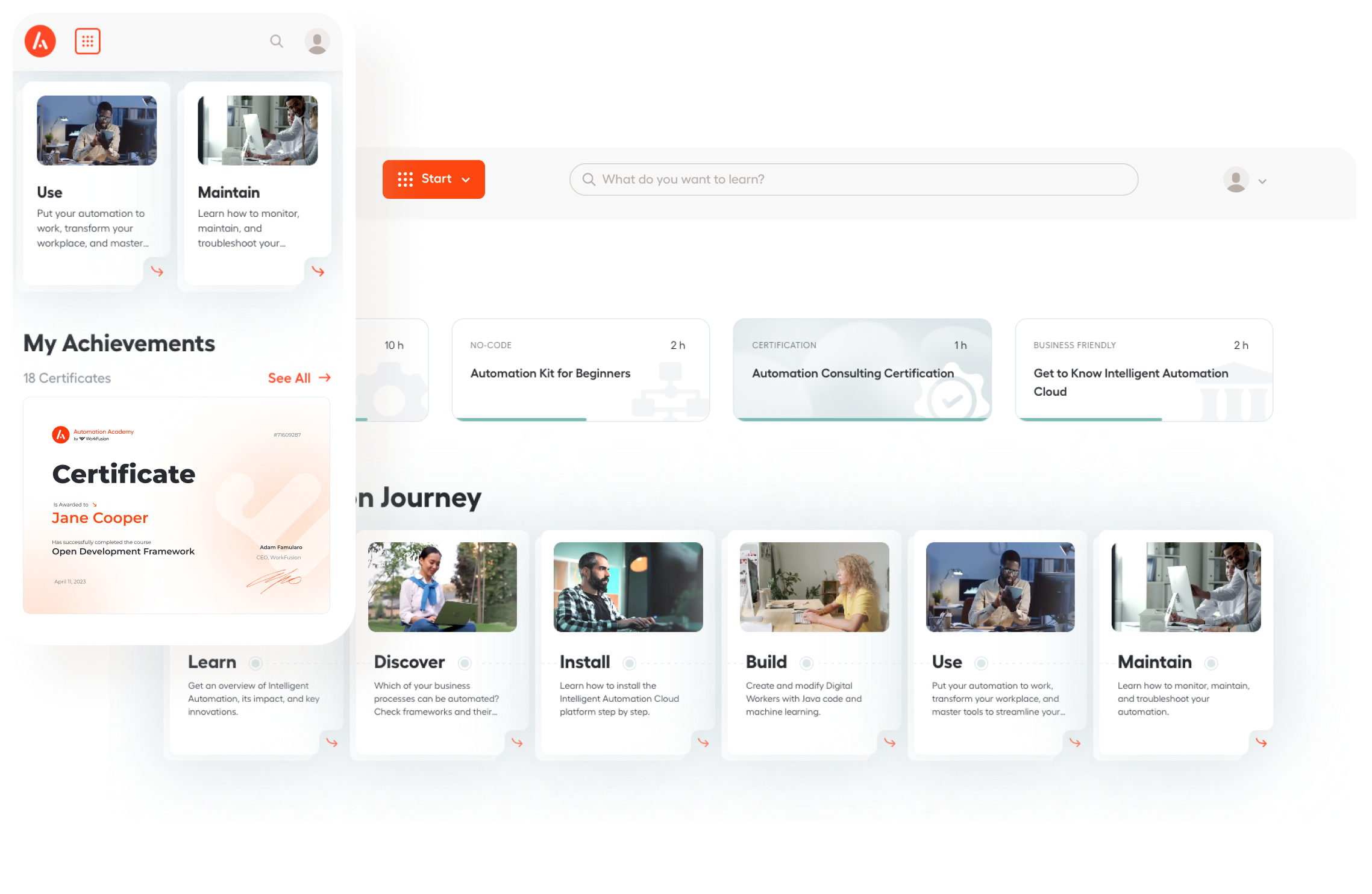

All-in-one platform

Learn, practice, and test your new automation skills.

- Courses tailored to each role

- Hands-on training with our automation platform

- Step-by-step video tutorials

- Shareable digital certificates

- Assignments that replicate typical automation scenarios

- 24/7 support

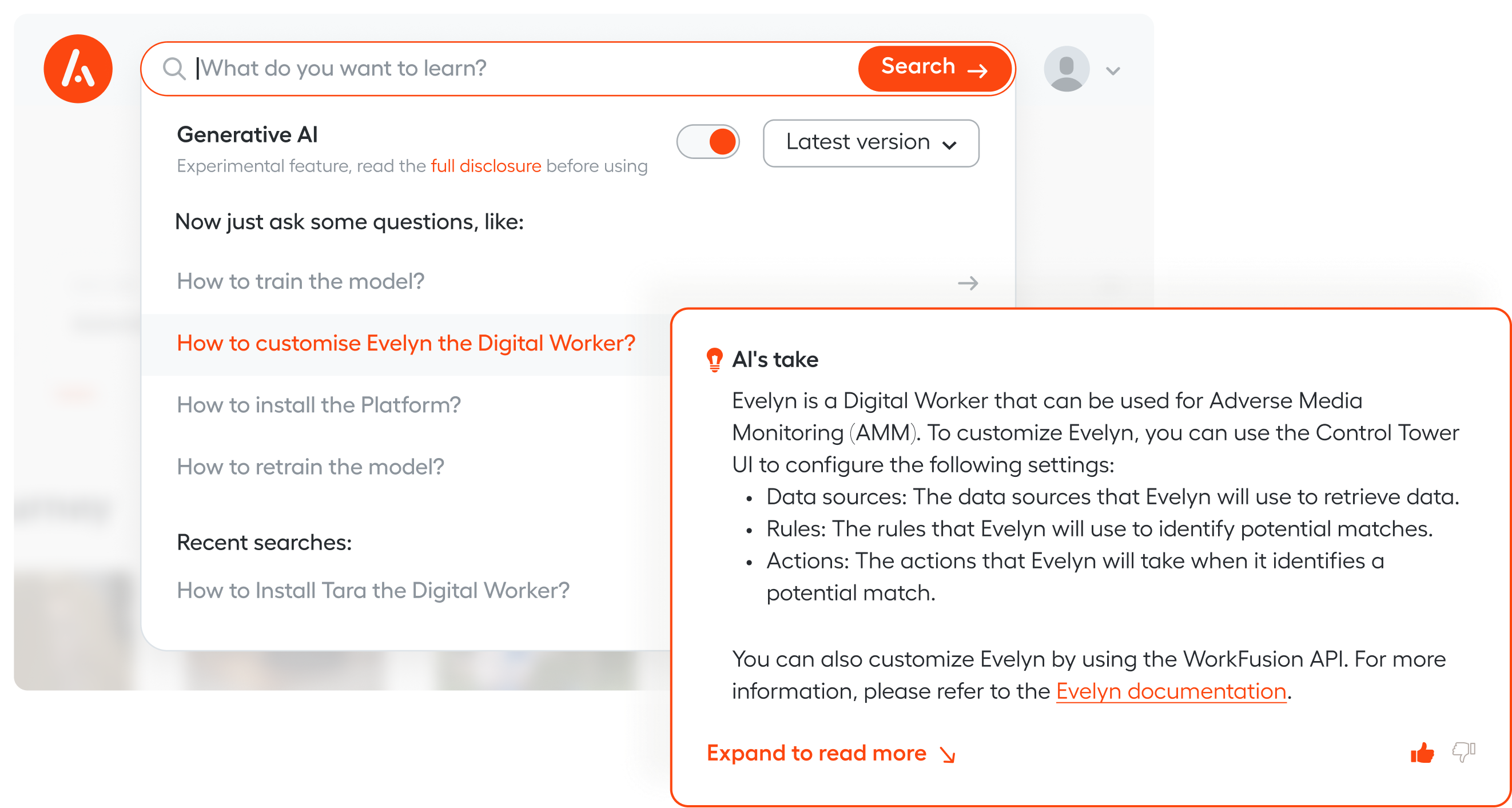

Ask questions —

get answers

Introducing a new generation of search powered by generative AI. Let it immerse you in the Intelligent Automation world and boost the adoption of AI-infused Digital Workers.

Introducing a new generation of search powered by generative AI.

Let it immerse you in the Intelligent Automation world and boost the adoption of AI-infused Digital Workers.

Upskill the entire team

Whether you’re a business user or developer, gain advanced automation skills.

Developers

Role-based training for all members of an automation team — from RPA Developers to Machine Learning Engineers and Data Analysts.

Operations

Automation training for operations specialists on how to identify strong automation use cases and turn business requirements into automated workflows.

Analysts

On-demand courses discuss automation approaches, best practices, and business benefits. Designed for forward-thinking leaders in banking, insurance and other industries.

IT

Designed for Platform Management and Support teams to learn how to set up, configure, monitor, manage and troubleshoot the platform.

for Programs

for Roles

for Courses

Welcome to class: In-person automation training

Customized and advanced automation training to level up your Center of Excellence.

Get started with out-of-the-box Digital Workers

After selecting Digital Worker(s) to join your team, learn how to work with your new colleague(s) and master platform capabilities.

Learn moreBuild your automation Center of Excellence

Build delivery, platform, and consulting teams that form your Automation CoE, which creates, modifies, and maintains Digital Workers.

Learn moreYour partner in digital transformation

Enterprise customers train with us and achieve automation success.

1,200+

hours of curriculum

50+

courses

We are already using robots in the insurance business. Thanks to the combination of Robotic Process Automation (RPA) and Artificial Intelligence, we are now able to intelligently automate the entire process end-to-end.

HDI Versicherung

50,000+

trainees

80%

trainees graduated