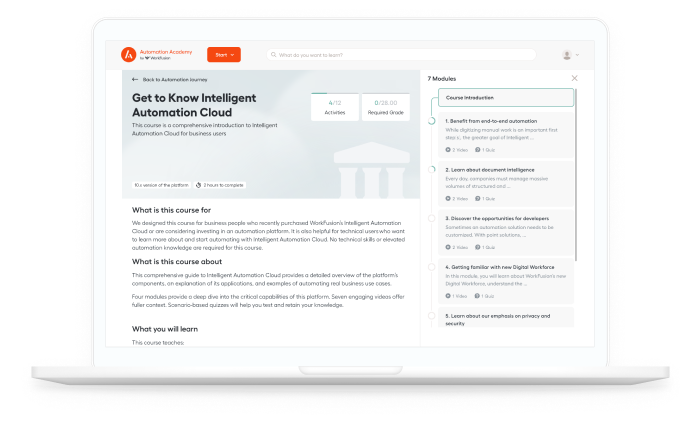

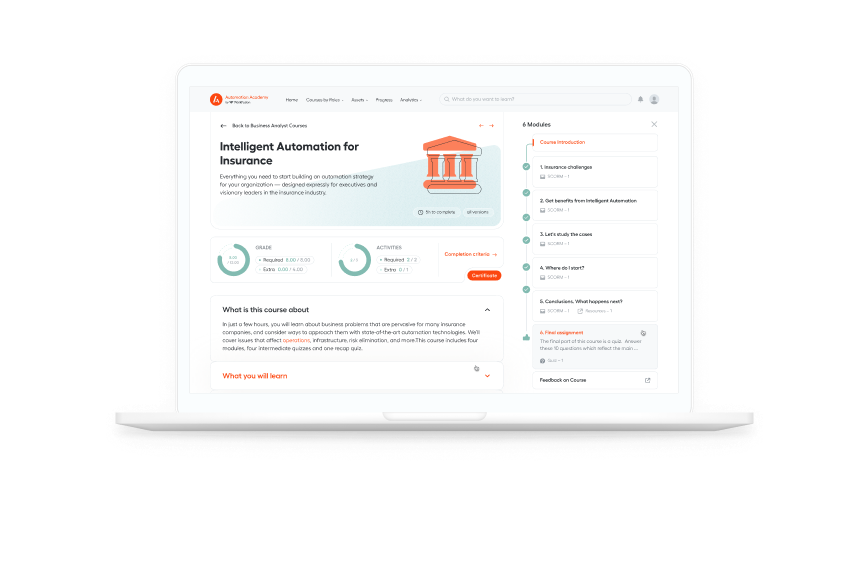

What is this course about

In just a few hours, you will learn about business problems that are pervasive for many banks, and consider ways to approach them with state-of-the-art automation technologies. We’ll cover issues that affect operations, infrastructure, risk elimination, and more.

What you’ll learn

- Four critical challenges to banking

- Why many banks’ current strategy is flawed

- How to redefine your automation strategy

- Perspectives for banks’ development and investments

Who this course is for

- This course is designed for banking executives

- Leaders seeking to improve their businesses with advanced technologies.

Course content modules

Banking challenges

Benefits of Intelligent Automation

Study real use cases

Where to start?